Wall Street’s main indexes tumbled on Friday, on course for their worst weekly performance of the year, as data signaling strong consumer spending and inflation sparked worries that the Federal Reserve will stick to its hawkish stance for longer.

Data on Friday showed the personal consumption expenditures (PCE) price index, the Fed’s preferred gauge of inflation, shot up 0.6% last month after gaining 0.2% in December.

Brent crude futures rose 1%, to 83.01 dollars per barrel. Brent crude prices were some 14% lower than a year earlier. They hit a 14-year high of nearly 128 dollars per barrel on March 8 last year.

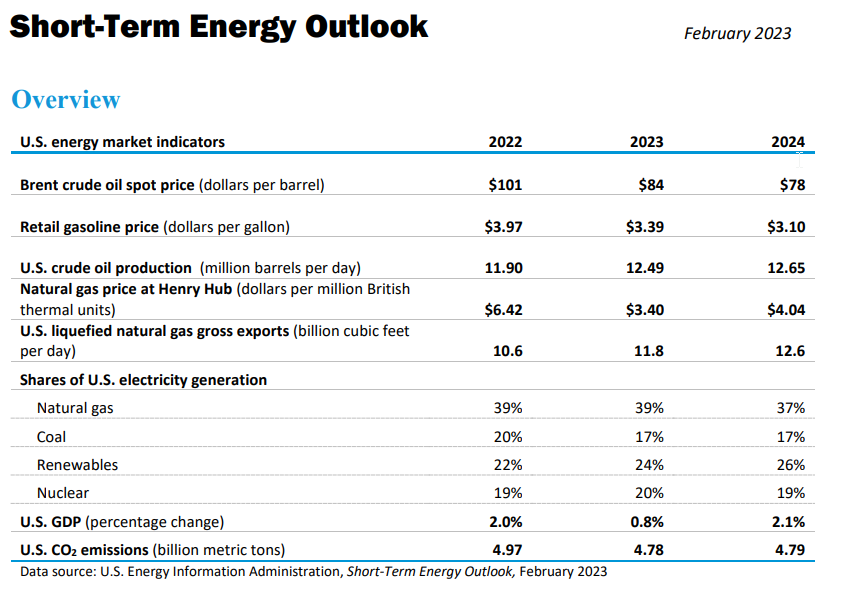

The U.S. Energy Information Administration is forecasting the Brent crude price at $84 for 2023 having Retail Gasoline Price at $ 3.39 per gallon.

World shares limped toward their biggest weekly fall of the year on Friday, though investors took heart from a brief dip in government bond yields as the incoming Bank of Japan chief ruled out an early end to its super-easy

ANALYSTS RATINGS:

JP Morgan maintains overweight on Nvidia, raises price target to $250 having and upside potential amounting to ~21%. Also, Citigroup and BMO Capital Markets reiterated Palo Alto Networks (PANW) coverage with buy and target $220 and $ 228 respectively.

Needham maintains buy on Unity Software, raises price target to $44, and Loop Capital initiated Walgreens Boots Alliance (WBA) coverage with buy and target $45.

Roth Mkm initiates coverage on Immix Biopharma (IMMX) with buy rating, announces price target of $14 setting a ~511% upside potential.